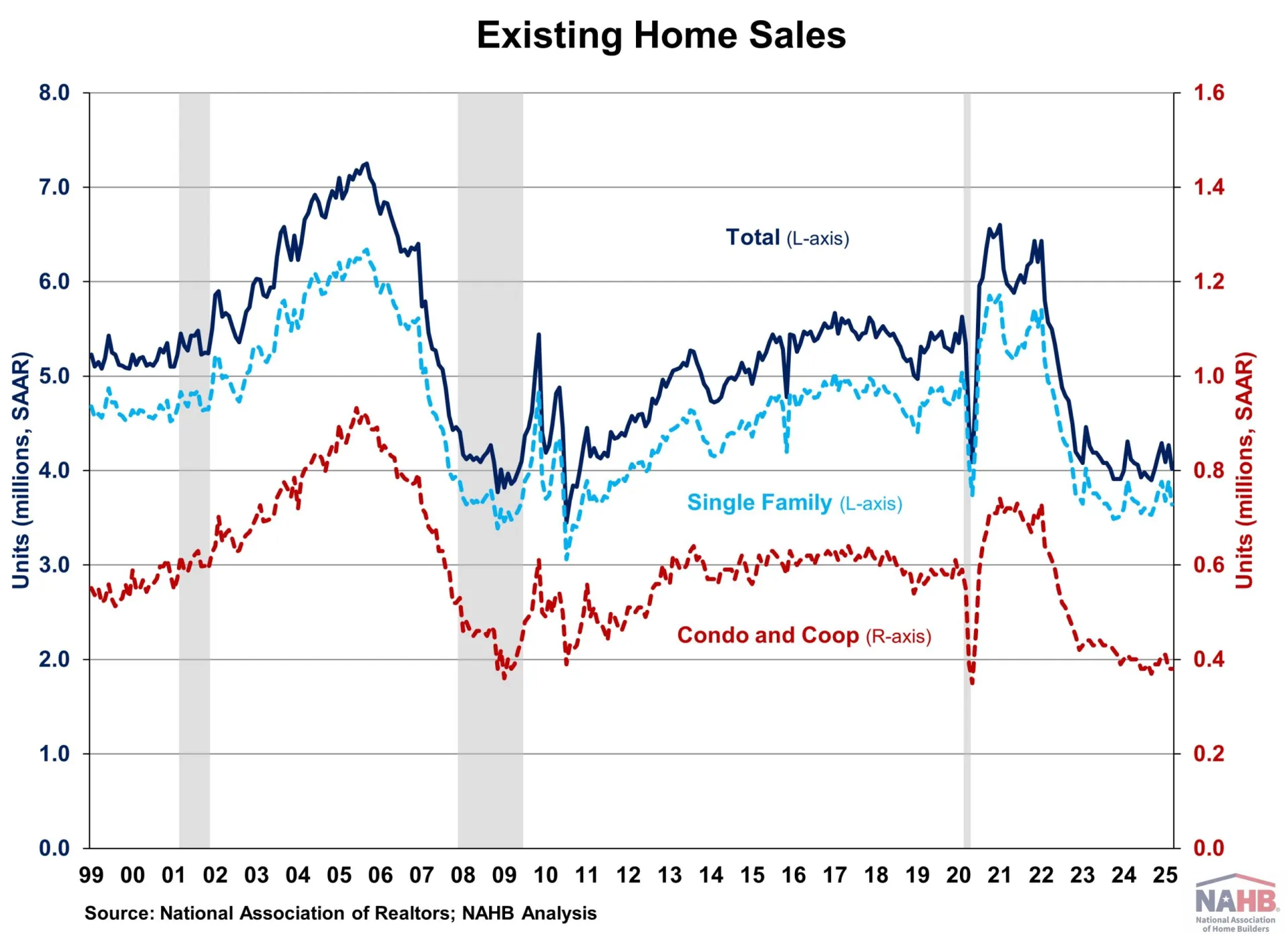

Existing Home Sales Dropped in March, Hampered by Affordability

According to the National Association of Realtors (NAR), existing home sales fell in March as affordability concerns continued to weigh on the market.

For the first time in March, the median home price exceeded $400,000, emphasizing the persistent pressure on prospective buyers.

While mortgage rates have somewhat decreased, ongoing economic uncertainties may continue to hamper buyer activity in the foreseeable future.

While existing home inventory increases and the Fed continues to lower interest rates, the market faces challenges as mortgage rates are predicted to remain over 6% for longer due to a slower softening pace in 2025.

These protracted rates may continue to deter homeowners from exchanging existing mortgages for new ones with higher rates, limiting supply and raising costs.

As a result of the elevated mortgage rates and housing prices, sales are expected to remain constrained in the coming months.

In March, total existing home sales, which include single-family homes, townhomes, condominiums, and co-ops, fell 5.9% to 4.02 million on a seasonally adjusted yearly basis. Sales were 2.4% lower than a year ago.

The percentage of first-time purchasers increased to 32% in March, up from 31% in February and remaining steady from March 2024.

The existing house inventory stood at 1.33 million units in March, up 8.1% from February and 19.8% from a year ago.

At the current sales rate, March unsold inventory totals 4.0 months, up from 3.5 months in February and 3.2 months in March 2024.

This inventory level remains low in comparison to balanced market circumstances (4.5 to 6 months’ supply), highlighting the long-term need for greater home building.

In March, homes were on the market for an average of 36 days, down from 42 in February but up from 33 in March 2024.

The March all-cash sales percentage was 26% of total transactions, down from 32% in February and 28% a year ago.

In March, the median sales price of all existing homes was $403,700, up 2.7% over the previous year.

This represented the 21st consecutive month of year-over-year growth. In March, the median condominium/co-op price was $363,000.

This was up 1.5% from the previous year. As inventory increases, the rate of price growth will slow.

Existing home sales fell in all four major U.S. regions during March.

The West suffered the biggest loss, with sales dropping 9.4%, followed by the South (-5.7%), the Midwest (-5.0%), and the Northeast (-2.0%).

Year over year, sales increased by 1.3% in the West, fell by 4.2% and 3.1% in the South and Midwest, and stayed steady in the Northeast.

The Pending Home Sales Index (PHSI) is a contract-based indicator that forecasts future home sales.

In February, the PHSI plummeted from 70.6 to a record low of 67.3 points.

This drop shows that rising property prices and increasing mortgage rates continue to limit affordability.

According to National Association of Realtors data, pending sales fell 9.9% year on year.

[Read more about this story at Eyeonhousing.org]