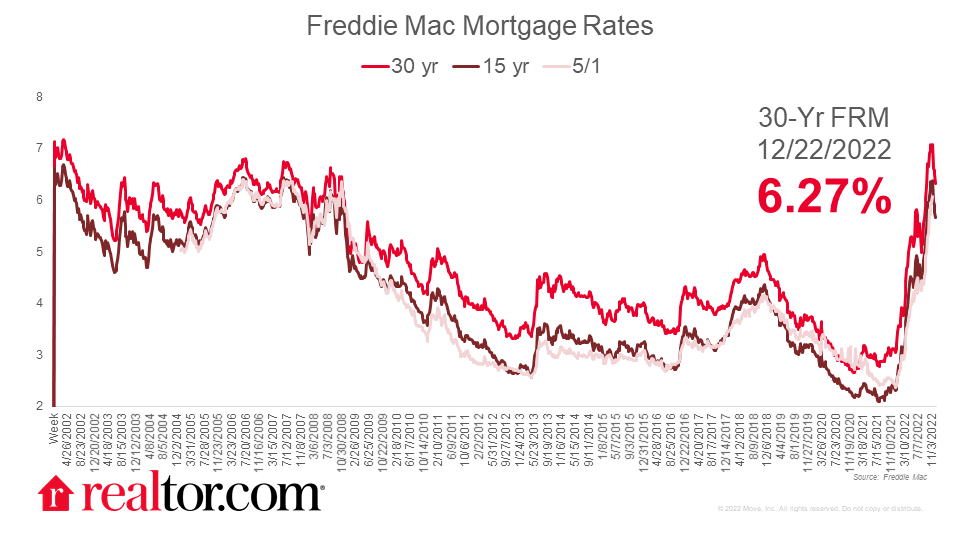

Freddie Mac: Mortgage rates fall slightly as consumer confidence reaches 8-month high

The results of Freddie Mac‘s Primary Mortgage Market Survey (PMMS) were revealed today, and the 30-year fixed-rate mortgage (FRM) averaged 6.27%.

The Freddie Mac fixed rate on a 30-year loan continued to fall from last week, falling 4 basis points to 6.27%, despite the 10-year Treasury rising during the last week.

Investors were pleased with this week’s consumer confidence statistics, which reached an eight-month high.

Markets are anticipating tomorrow’s Personal Consumption Expenditure price index figures, which are expected to reflect the CPI’s decrease and signal to a slowing in inflation.

While the economy is not totally out of the woods, further slowing in inflation would be welcome news for capital markets seeking more certainty about the course of the economy in the coming year.

© realtor.com

Mortgage rates are currently keeping homebuyers and sellers on the defensive.

A median-priced home now has a monthly payment of more than $2,000, a 64% increase from a year ago, when prices were climbing by double digits but interest rates were less than half of what they are now.

First-time homebuyers are facing high consumer prices, property values, and interest rates, which are causing savings rates to plummet and delaying their ability to save a substantial down payment.

At the same time, current homeowners looking for their next house are finding that the prospect of higher costs and, in many cases, borrowing rates that are double or treble their present rate is making them reconsider their choice to move.

This combination is resulting in a large dip in real estate transactions, as evidenced by this week’s drop in existing house sales data.

A huge proportion of purchasers are finding their route to homeownership obstructed by financial obstacles.

Not unexpectedly, the desire for affordability is bringing many people to lower-cost urban areas where the cost of a property is more affordable for many families.

Markets such as Manchester, New Hampshire, Columbus, Ohio, Fort Wayne, Indiana, Hartford, Connecticut, Lancaster, Pennsylvania, and Topeka, Kansas, are still seeing property sales as purchasers from more costly areas are drawn in by strong local economies and median prices that are still below $300,000.