NAHB: Private Residential Construction Spending Declines in March

According to the NAHB’s analysis of Census data, private residential construction spending fell 0.7% in March after rising 0.7% in February.

It had a seasonally adjusted annual rate of $884.3 billion.

In March, spending on single-family building fell by 0.2%. This is the first monthly decrease following ten months of consecutive rises, as rising mortgage interest rates have dampened the home market.

Single-family construction spending increased by 18.3% over the previous year.

Multifamily construction spending fell by 0.6% in March, following a 0.3% fall in February.

However, investment on multifamily development increased by 3.5% over the previous year, owing to the substantial stock of multifamily homes under construction.

Nonetheless, multifamily building investment will fall in the next quarters as an elevated level of apartments under construction is completed. Private residential improvement spending declined 1.6% in March, after remaining steady in February. It was 9.9% lower than a year earlier.

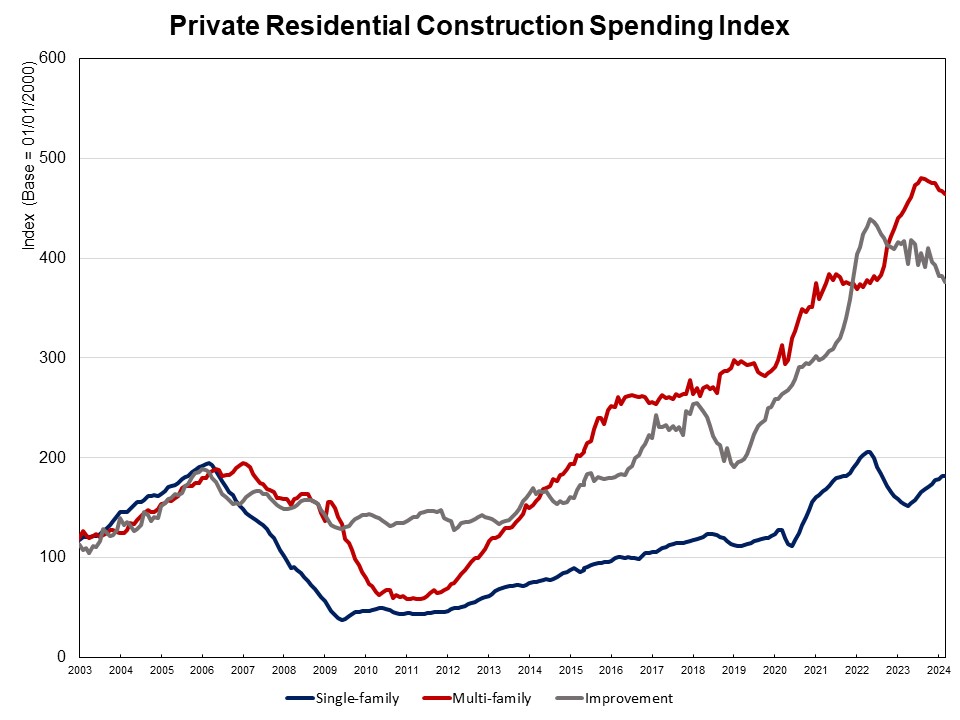

The graph below depicts the NAHB building spending index (with March 2000 as the base).

The index shows how single-family construction spending has increased steadily since May 2023, despite supply-chain problems and rising interest rates.

Multifamily construction spending growth has been nearly steady in the last three months, while improvement spending has declined since mid-2022.

Spending on private nonresidential construction increased 11.1% over the previous year.

The annual rise in private nonresidential spending was mostly attributable to increasing spending in the manufacturing category ($45.6 billion), followed by power ($0.6 billion).

(Read more about this topic on Eyeonhousing.org)