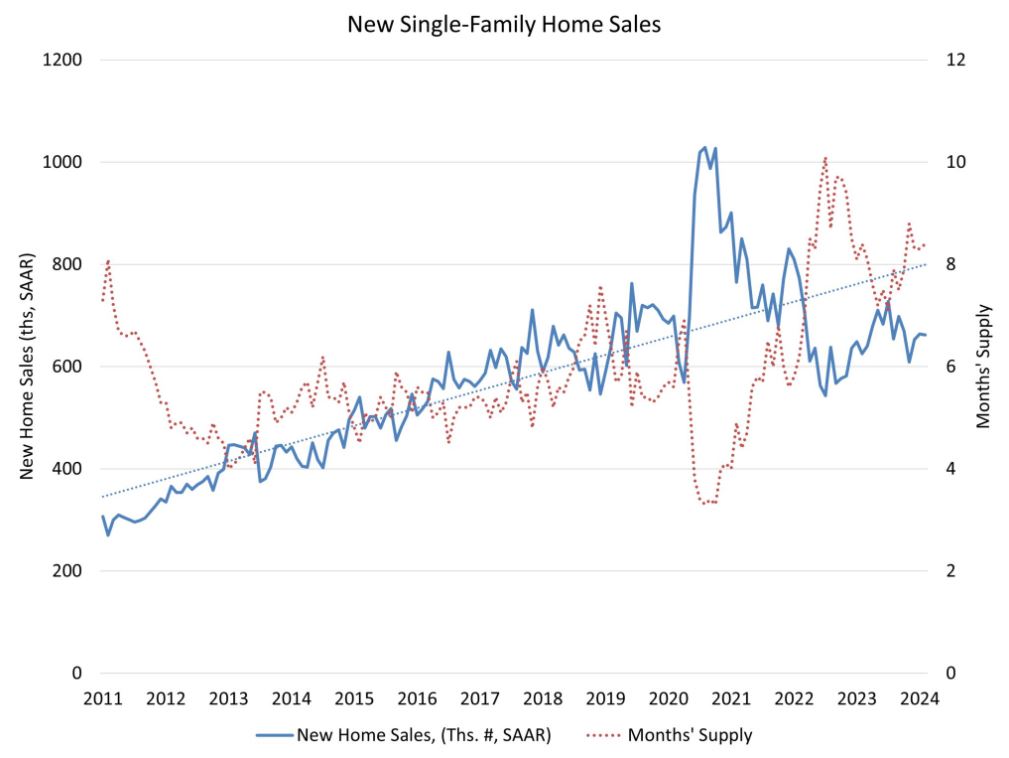

New Home Sales Remain Stable in February Despite Rising Mortgage Rates

New home sales activity held firm in February, defying a slight increase in mortgage rates. While sales dipped a marginal 0.3% compared to January, they remain 5.9% higher year-over-year.

This data comes from the latest report by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

The median new home price saw a slight correction, dropping 3.5% from January and 7.6% compared to February 2023.

Builders are adapting to market changes, with the NAHB/Wells Fargo HMI reporting roughly 25% offering price reductions in March alongside slightly smaller home footprints.

Inventory Levels: A Mixed Bag

New home inventory presents a complex picture. While overall stock remains elevated at 463,000 units (an 8.4-month supply), completed and move-in ready homes have surged by 23% year-over-year (85,000 units).

Conversely, homes under construction have declined by 2%.

This trend suggests builders are prioritizing completing existing inventory rather than starting new projects.

Regional Sales Trends Diverge

The national sales figures mask significant regional variations. The Northeast, Midwest, and West have all experienced significant year-to-date sales growth (47.0%, 29.7%, and 41.0% respectively).

However, the South bucks this trend, with sales dropping 13.4% compared to the same period last year.

Outlook: Balancing Supply and Demand

As interest rates are expected to stabilize throughout 2024, more buyers may enter the market, potentially increasing demand.

However, rising existing home inventory also looms on the horizon.

Monitoring new home inventory, particularly completed units, will be crucial in the latter half of the year to gauge market equilibrium.

(Source: Eyeonhousing.org)