Single-Family Starts Dip, Multifamily Starts Rise in December

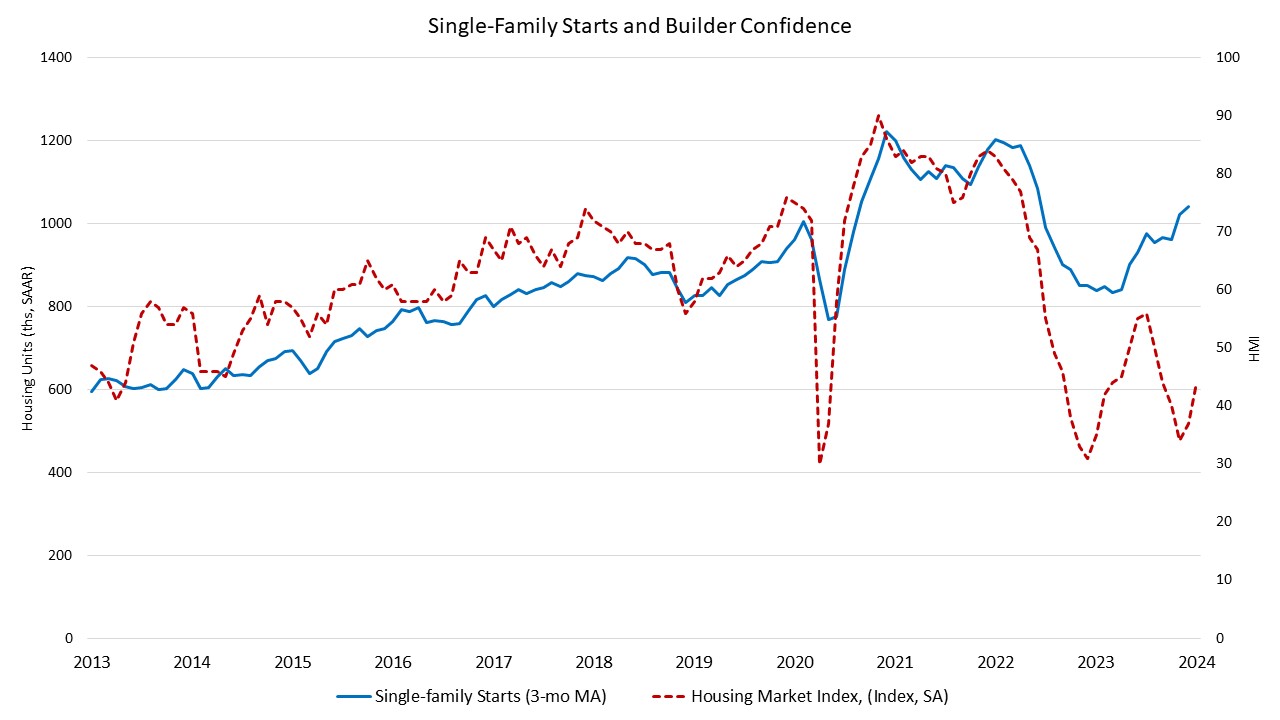

Despite a slight dip in overall housing starts, the single-family sector continued to show strength in December, exceeding one million units for the second consecutive month.

This suggests that lower mortgage rates are still providing a boost to the housing market.

According to a joint report by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, overall housing starts fell 4.3% in December, settling at a seasonally adjusted annual rate of 1.46 million units.

This follows an unusually strong reading in November.

The December figure represents the pace of housing starts if current trends were to hold for the next year.

Within this overall number, single-family starts decreased 8.6% to a seasonally adjusted annual rate of 1.03 million units.

However, this still represents a 15.8% increase compared to December 2022.

The three-month moving average, which helps smooth out recent volatility, remains above 1.0 million starts.

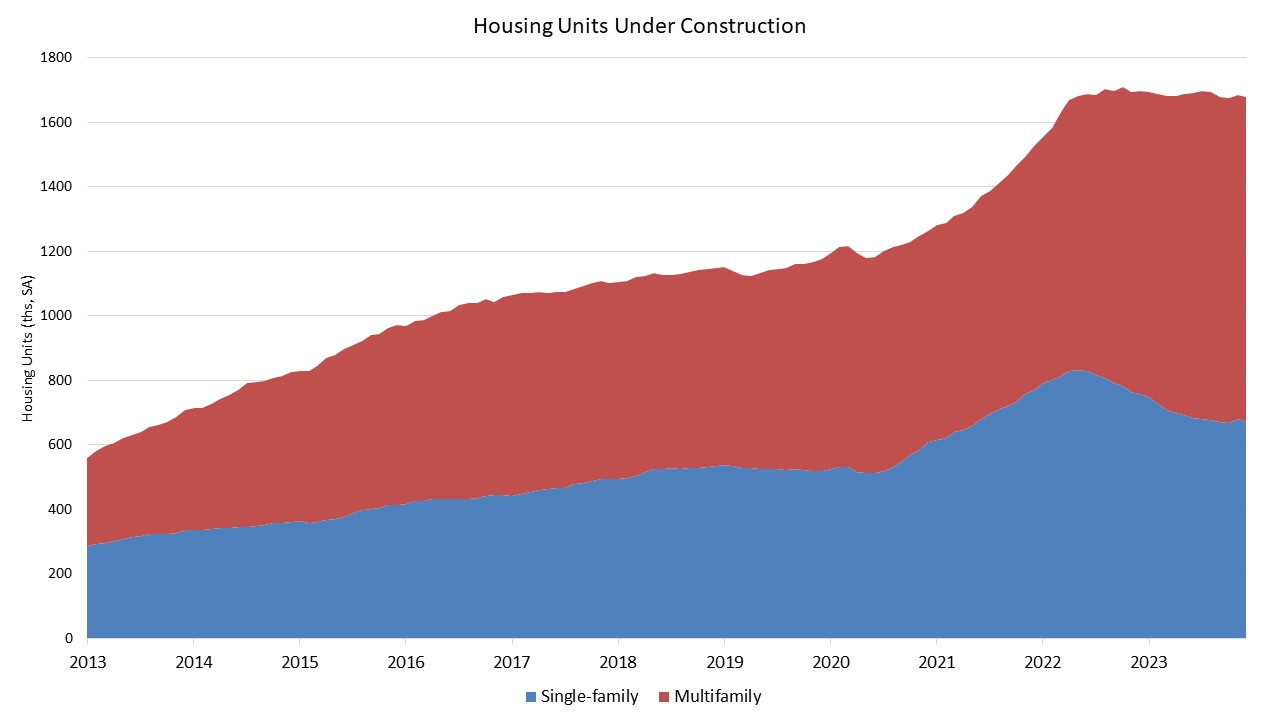

In contrast, the multifamily sector, which encompasses rental apartments and condos, saw an increase of 8.0% in December, reaching an annualized pace of 433,000 units for buildings with two or more units.

The three-month moving average for multifamily construction has been trending upwards, currently at a 412,000-unit annual rate.

However, on a year-over-year basis, multifamily construction is down 7.9%.

Highlights:

- Single-family starts remain strong: Despite a small dip in December, single-family starts are still up 15.8% year-over-year. This suggests that lower mortgage rates are continuing to attract buyers to the market.

- Multifamily construction is on the rise: The multifamily sector saw an increase in December, and the three-month moving average is trending upwards. This indicates that demand for rental housing is growing.

- Overall housing starts are down slightly: Overall housing starts declined in December, but they are still up 6.1% year-to-date. This suggests that the housing market is still growing, but the pace of growth may be slowing.

(Source: Eyeonhousing.org)