US Homeownership Rate Falls to Five-Year Low

According to the Census’ Housing Vacancy Survey (HVS), the homeownership rate fell to 65.1% in the first quarter of 2025, its lowest level since the first quarter of 2020.

dwellings affordability has reached a multidecade low amidst rising mortgage interest rates and a scarcity of available dwellings.

The homeownership rate is 4.1 percentage points lower than the peak of 69.2% in 2004, and it remains below the 25-year average of 66.3%.

Over the last year, homeownership rates have fallen in practically every age category except those 65 and older.

Among younger households, the homeownership rate for individuals under 35 fell slightly to 36.6% in the first quarter of 2025, compared to a year ago.

However, it remains at the lowest rate in the previous six years. This age group, which is most vulnerable to mortgage rates and the availability of entry-level homes, experienced the greatest fall of any age group (1.1 percentage points).

Similar declines were observed in the 35-44 and 55-64 age categories, with rates dropping from 61.4% to 60.3% and 76.3% to 75.2%, respectively.

Homeownership rates among those aged 45 to 54 fell slightly, from 70.8% to 70.6%. In comparison, individuals 65 and older saw a slight gain, rising from 78.7% to 79%.

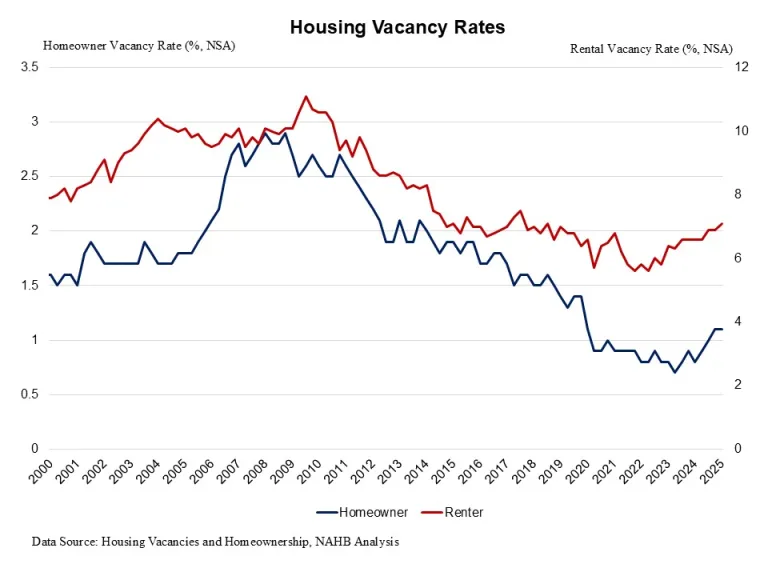

The nationwide rental vacancy rate improved to 7.1% in the first quarter of 2025, reverting to pre-pandemic levels following several years of tight rental market conditions.

Meanwhile, the homeowner vacancy rate remained at 1.1%, which is close to the survey’s 67-year low of 0.7%.

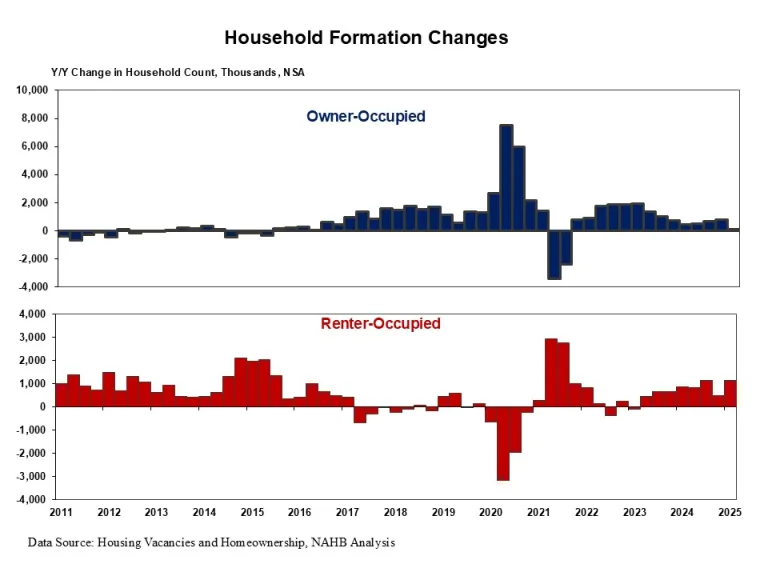

According to the housing stock-based HVS, total households climbed to 132.2 million in the first quarter of 2025, up from 131.0 million the previous year.

Gains are attributed to a rise in both renter household formation (1.2 million) and owner-occupied households (106,000).

[Read more about this story at Eyeonhousing.org]