The third quarter of 2023 saw a continued tightening of credit availability for residential AD&C loans, according to both the National Association of Home Builders (NAHB) AD&C Financing survey and the Federal Reserve’s survey of senior loan officers.

Both surveys produce a net easing index that indicates the direction of credit conditions. A positive index indicates easing credit, while a negative index indicates tightening credit.

In the third quarter, both the NAHB and Fed indices were negative, signaling a consensus among builders and lenders that credit conditions were tightening overall.

The NAHB index posted a reading of -49.3, down considerably from -35.3 in the second quarter.

This represents the most widespread reporting of tightening by builders since the 2010 trough of the Great Recession.

Credit tightening was even more prevalent among lenders in the third quarter, as evidenced by the Fed’s net easing index of -64.9 (compared to -71.7 in the second quarter).

Both the Fed and NAHB indices shifted from indicating net easing to net tightening at the start of 2022 and have remained solidly in negative territory for the last seven quarters.

The NAHB survey revealed the primary methods lenders employed to tighten credit during the third quarter:

- Increasing interest rates: 80% of builders and developers reported tighter credit conditions due to higher interest rates.

- Reducing loan amounts: 57% of respondents faced reduced loan amounts.

- Lowering loan-to-value (LTV) or loan-to-cost (LTC) ratios: 52% of builders and developers experienced stricter LTV or LTC requirements.

The impact of credit tightening on loan costs varied depending on the type of loan. For single-family construction loans, the average contract interest rate increased:

- Speculative construction: 8.37% to 8.66%

- Pre-sold construction: 8.18% to 8.37%

In contrast, the average contract rate declined for loans for land acquisition (from 8.62% to 8.31%) and land development (from 8.70% to 7.78%).

Despite the decline in average contract rates for land acquisition and land development loans, the average initial points increased for all four loan categories:

- Land acquisition: 0.52% to 0.86%

- Speculative single-family construction: 0.71% to 0.93%

- Pre-sold single-family construction: 0.44% to 0.86%

- Land development: 0.81% to 0.58%

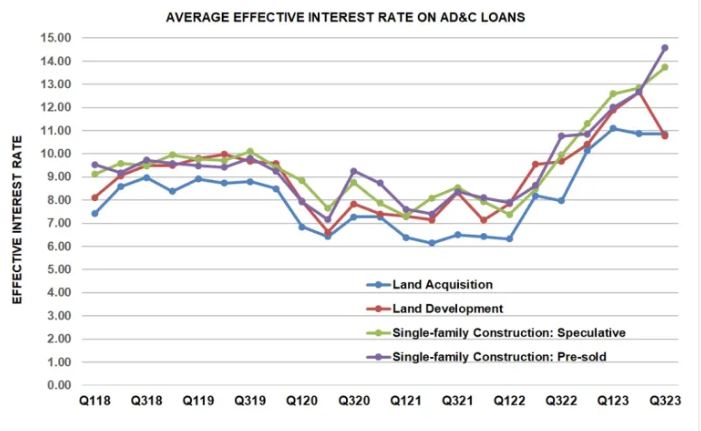

Despite these changes, the average effective interest rate, which takes into account both the contract interest rate and initial points, declined slightly for loans limited to land acquisition (from 10.87% to 10.85%) but more significantly for loans for land development (from 12.67% to 10.76%).

Even after these reductions, the effective rate on AD&C loans remained higher than at any time between 2018 and 2022.

The effective rate paid by single-family builders on construction loans continued to climb, consistent with the trend over the previous five quarters:

- Speculative construction: 12.85% to 13.74%

- Pre-sold construction: 12.67% to 14.57%

The persistent tightening of credit conditions is likely to continue impacting the residential AD&C sector in the near term.

Builders and developers may face challenges in securing financing for new projects, potentially leading to a slowdown in construction activity.